Regulatory reporting

Reporting of your financial services regulatory requirements reliably and cost-effectively.

.jpg)

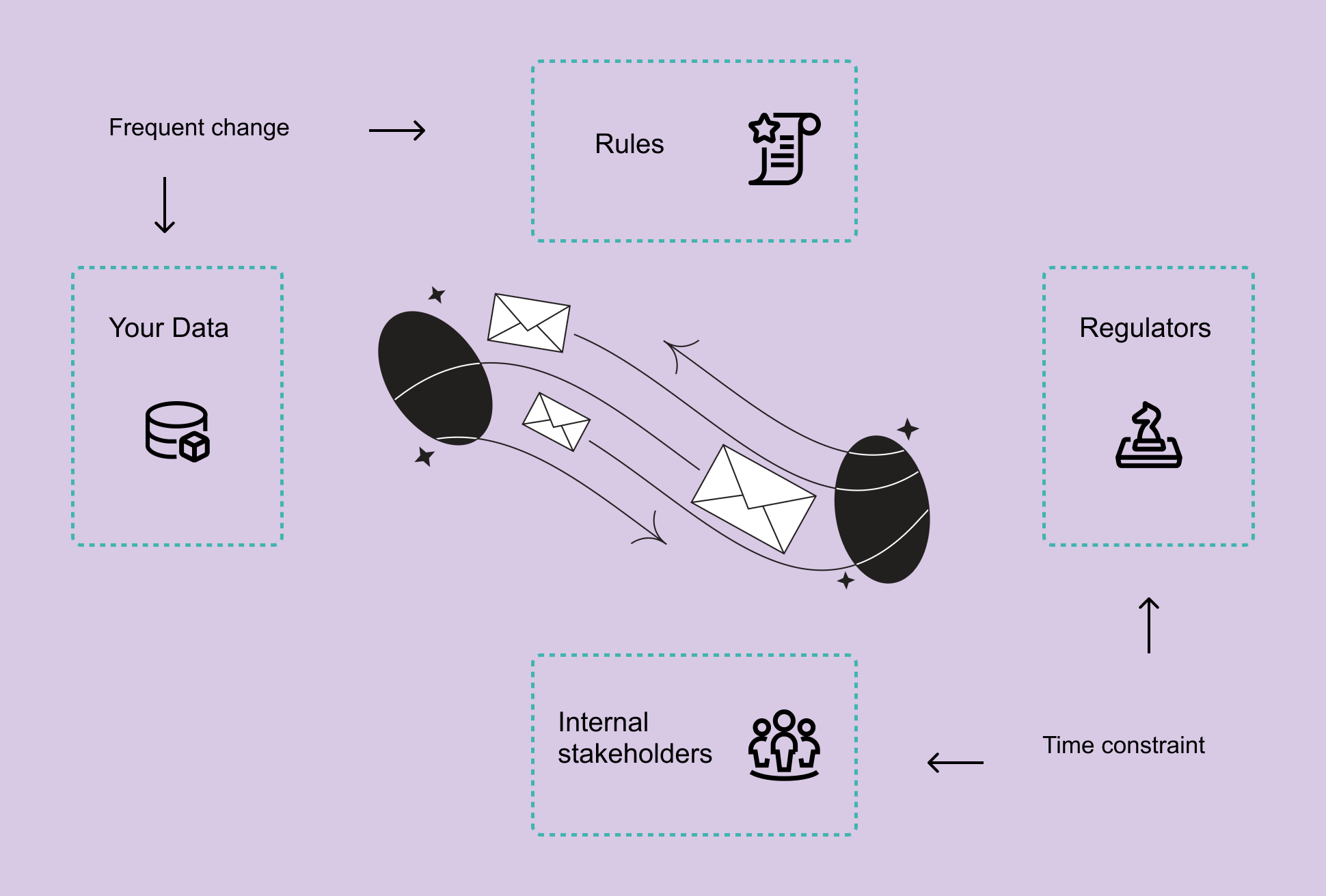

The risk management and regulatory supervision of financial services companies imposes new and ever-changing reporting requirements, and the fulfilment of which is often a prerequisite for the continuation of business operations or even retaining business licences.

The amount of information to be reported varies depending on the size of the reporting company and the scope of its operations, but is often complex and imposes a both a OPEX cost burden on Business as Usual (BAU) operations as well as a CAPEX to hire or retain consultants to update, often yearly changes.

Loihde offers a complete range of package services to avoid this complexity, allowing you and your organization to focus on growth and delivering excellence to your customers.

Leave a contact request to one of our experts and let's talk more.

Why choose Loihde?

Loihde has extensive experience of working in the banking and insurance industry.

We have developed a technical solution for regulatory reporting and it is used by several Finnish financial sector companies, and can be used throughout the EU.

We follow the development of regulatory reporting and develop our technical solution to meet changing requirements.

We offer a continuous service to support our solution, keeping up with cutting edge technologies sich as AI and GPT.

How can we help?

The financial services regulations are complex, multi-jurisdictional and ever changing. These needs to be mapped to your data, which can often also be complex, multi-jurisdictional and ever changing. This leads to a burden on your operations and stakeholders when meeting the demanding schedule of regulatory reporting.

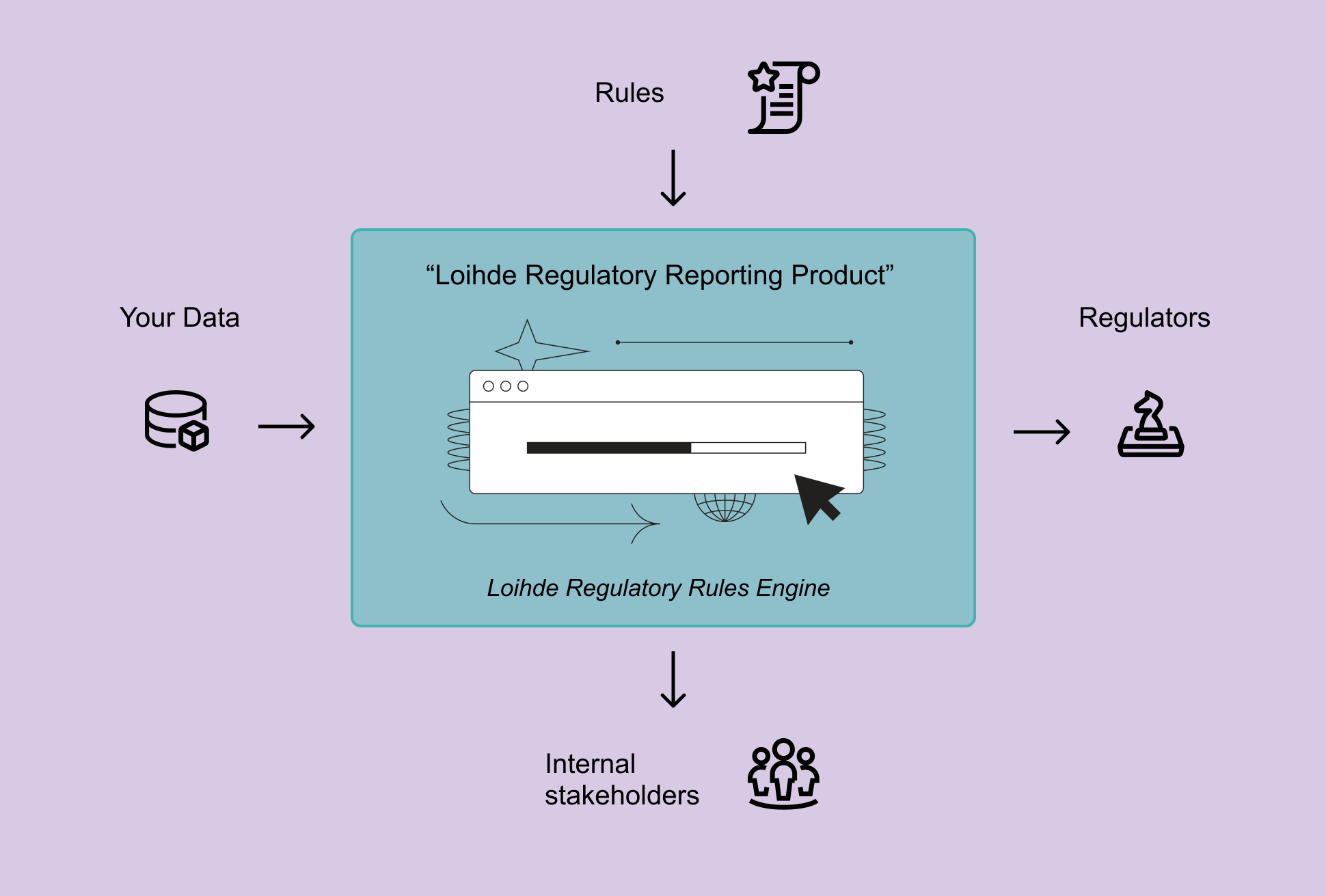

The Loihde Managed Solution is to provide you a single product that applies the right rules to the right data, at the right time. We also ensure our product keeps up to date with rules (and data) as they change

What do we do with regulatory reporting?

Requirement specification together with the customer

Install the technical components of the reporting solution

Adapt the reporting solution to the customer repository/reporting database

Testing and transfer to production

Our solution covers data collection, application of rules for extracting reported figures and the ability to manually and automatically adjust the data.

The browser-based user interface enables correction of initial data and audit trail of modified data.

The data to be reported is refined into the data format required by the authorities (e.g. WEB XBRL). Our architecture is flexible in that it can align to any data reporting tools you currently have, should you prefer to use your own.

How can the Loihde regulatory solution be used by your company?

What we can do?

-

Efficient and automated reporting process

-

Industry expertise in regulatory reporting, including staying ahead of future changes

-

Support for continuous service for regulatory reporting

What value is produced?

-

Reduction of manual work

-

Reduction of human error

-

High level of self-service reporting

-

Agile management and monitoring of the reporting process

-

An efficient process entity for utilising the organization's information.

-

Safe and secure handling of data

Types of Loihde offering

- Bespoke client service: We augment your environment with parts of our solution and know-how to make it easier for you. We would typically work along side you in a planned development phase and then provide post go-live support

- Client run product: We offer our product (or parts of it) to be run by the you yourselves on their environment. We would then provide regular updates as necessary as rules change. Product lifecycles would be shorter and would focus primarily on configuration and mappings

- Full SAAS product: We perform everything for you and securely either ingesting or interfacing with you cloud data. Whilst there still needs work on mapping this benefits from economies of scale and standardization. You would still have ownership and oversight on data, but we would undertake certain operational activities on your behalf.